Find more information by AREA, TOWN or URBANISATION .....

Cabo de Palos

Cartagena

El Carmoli

Islas Menores and Mar de Cristal

La Manga Club

La Manga del Mar Menor

La Puebla

La Torre Golf Resort

La Union

Los Alcazares

Los Belones

Los Nietos

Los Urrutias

Mar Menor Golf Resort

Pilar de la Horadada

Playa Honda / Playa Paraiso

Portman

Roldan and Lo Ferro

San Javier

San Pedro del Pinatar

Santa Rosalia Lake and Life resort

Terrazas de la Torre Golf Resort

Torre Pacheco

Cartagena

El Carmoli

Islas Menores and Mar de Cristal

La Manga Club

La Manga del Mar Menor

La Puebla

La Torre Golf Resort

La Union

Los Alcazares

Los Belones

Los Nietos

Los Urrutias

Mar Menor Golf Resort

Pilar de la Horadada

Playa Honda / Playa Paraiso

Portman

Roldan and Lo Ferro

San Javier

San Pedro del Pinatar

Santa Rosalia Lake and Life resort

Terrazas de la Torre Golf Resort

Torre Pacheco

Aguilas

Aledo

Alhama de Murcia

Bolnuevo

Camposol

Condado de Alhama

Fuente Alamo

Hacienda del Alamo Golf Resort

Lorca

Mazarron

Puerto de Mazarron

Puerto Lumbreras

Sierra Espuna

Totana

Aledo

Alhama de Murcia

Bolnuevo

Camposol

Condado de Alhama

Fuente Alamo

Hacienda del Alamo Golf Resort

Lorca

Mazarron

Puerto de Mazarron

Puerto Lumbreras

Sierra Espuna

Totana

Abanilla

Abaran

Alcantarilla

Archena

Blanca

Corvera

El Valle Golf Resort

Hacienda Riquelme Golf Resort

Lorqui

Molina de Segura

Mosa Trajectum

Murcia City

Peraleja Golf Resort

Ricote

Sucina

Abaran

Alcantarilla

Archena

Blanca

Corvera

El Valle Golf Resort

Hacienda Riquelme Golf Resort

Lorqui

Molina de Segura

Mosa Trajectum

Murcia City

Peraleja Golf Resort

Ricote

Sucina

Urbanisations

CamposolCondado de Alhama

El Valle Golf Resort

Hacienda del Alamo Golf Resort

Hacienda Riquelme Golf Resort

Islas Menores and Mar de Cristal

La Manga Club

La Torre Golf Resort

Mar Menor Golf Resort

Mazarron Country Club

Mosa Trajectum

Peraleja Golf Resort

Santa Rosalia Lake and Life resort

Terrazas de la Torre Golf Resort

La Zenia

Lomas de Cabo Roig

Important Topics:

CAMPOSOL TODAY Whats OnCartagena SpainCoronavirusCorvera Airport MurciaMurcia Gota Fria 2019Murcia property news generic threadWeekly Bulletin

CAMPOSOL TODAY Whats OnCartagena SpainCoronavirusCorvera Airport MurciaMurcia Gota Fria 2019Murcia property news generic threadWeekly Bulletin

The payment period for this years Vehicle tax or IVTM is now open and there has been an increase since last year. Information and details on how and where to pay are as follows:

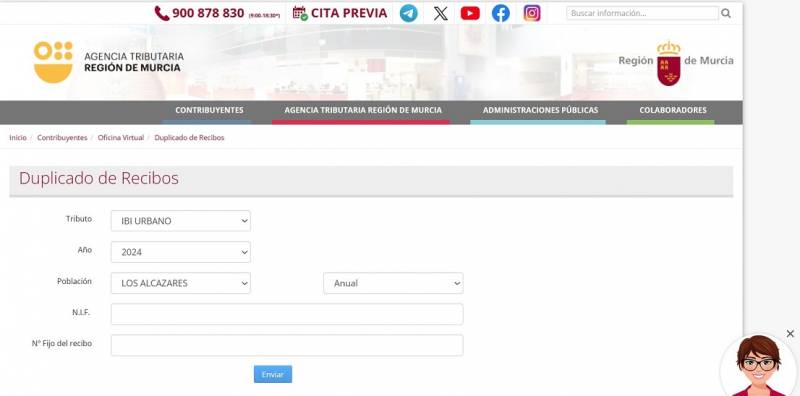

The payment period for this years Vehicle tax or IVTM is now open and there has been an increase since last year. Information and details on how and where to pay are as follows: On the first page in the Tributo/Tribute box click on the drop down and click on I. VEHICULOS TRACCION MECANICA/I. MECHANICAL TRACTION VEHICLES, then the Año/Year box 2024 (unless you wish to pay previous years), in the Población/Population box drop down click “MAZARRON”, leave the Anual/Annual box as is, then enter your N.I.E number in the N.I.F box and your vehicle registration number in the Matrícula/Fixed receipt number box, then click the Enviar/Send button and a PDF copy of your vehicle tax document should appear, this can then be downloaded and printed using the icons at the top right of the page.

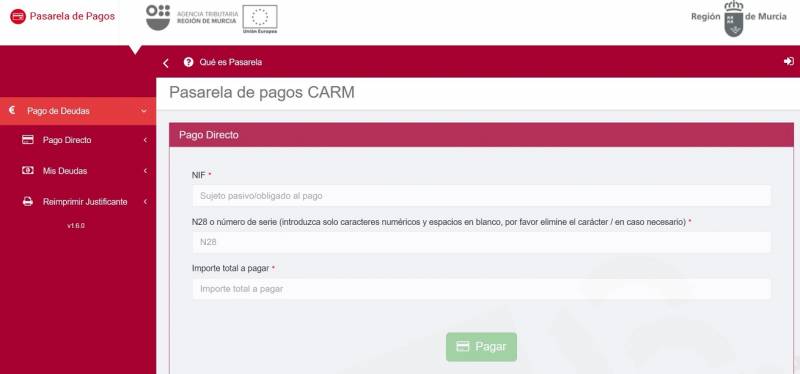

On the first page in the Tributo/Tribute box click on the drop down and click on I. VEHICULOS TRACCION MECANICA/I. MECHANICAL TRACTION VEHICLES, then the Año/Year box 2024 (unless you wish to pay previous years), in the Población/Population box drop down click “MAZARRON”, leave the Anual/Annual box as is, then enter your N.I.E number in the N.I.F box and your vehicle registration number in the Matrícula/Fixed receipt number box, then click the Enviar/Send button and a PDF copy of your vehicle tax document should appear, this can then be downloaded and printed using the icons at the top right of the page. On the first page enter your NIE number in the NIF box, in the N28 o número de serie/N28 or serial number box enter the N28 number from your Vehicle tax document, in the Importe total a pagar/Total amount to pay box enter the amount payable as per the Vehicle tax document (Important note: make sure to use a comma instead of a decimal point or the procedure will not advance), when the three boxes are completed click Pagar/Pay and you will be taken to the payment page with payment options.

On the first page enter your NIE number in the NIF box, in the N28 o número de serie/N28 or serial number box enter the N28 number from your Vehicle tax document, in the Importe total a pagar/Total amount to pay box enter the amount payable as per the Vehicle tax document (Important note: make sure to use a comma instead of a decimal point or the procedure will not advance), when the three boxes are completed click Pagar/Pay and you will be taken to the payment page with payment options.