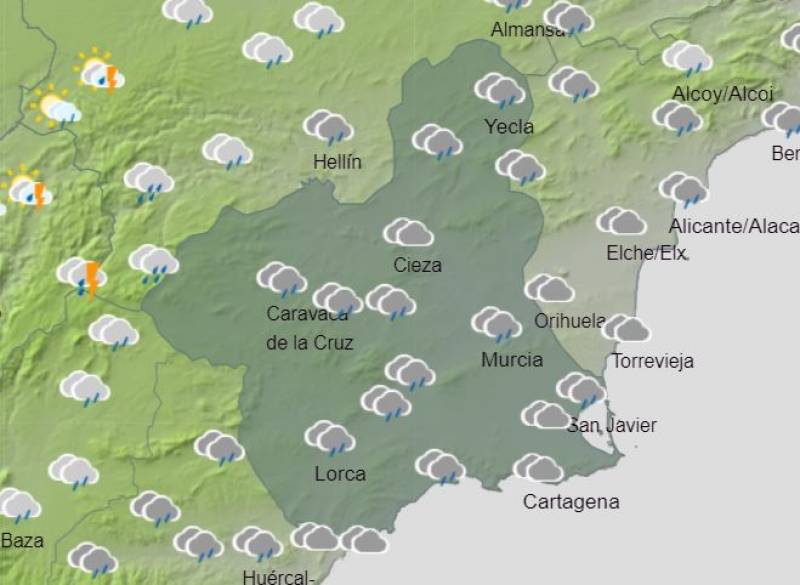

- Region

- Águilas

- Alhama de Murcia

- Jumilla

- Lorca

- Los Alcázares

- Mazarrón

- San Javier

-

ALL AREAS & TOWNS

- AREAS

- SOUTH WEST

- MAR MENOR

- MURCIA CITY & CENTRAL

- NORTH & NORTH WEST

- TOWNS

- Abanilla

- Abarán

- Aguilas

- Alamillo

- Alcantarilla

- Aledo

- Alhama de Murcia

- Archena

- Balsicas

- Blanca

- Bolnuevo

- Bullas

- Cañadas del Romero

- Cabo de Palos

- Calasparra

- Camping Bolnuevo

- Campo De Ricote

- Camposol

- Canada De La Lena

- Caravaca de la Cruz

- Cartagena

- Cehegin

- Ceuti

- Cieza

- Condado de Alhama

- Corvera

- Costa Cálida

- Cuevas De Almanzora

- Cuevas de Reyllo

- El Carmoli

- El Mojon

- El Molino (Puerto Lumbreras)

- El Pareton / Cantareros

- El Raso

- El Valle Golf Resort

- Fortuna

- Fuente Alamo

- Hacienda del Alamo Golf Resort

- Hacienda Riquelme Golf Resort

- Isla Plana

- Islas Menores & Mar de Cristal

- Jumilla

- La Azohia

- La Charca

- La Manga Club

- La Manga del Mar Menor

- La Pinilla

- La Puebla

- La Torre

- La Torre Golf Resort

- La Unión

- Las Palas

- Las Ramblas

- Las Ramblas Golf

- Las Torres de Cotillas

- Leiva

- Librilla

- Lo Pagan

- Lo Santiago

- Lorca

- Lorquí

- Los Alcázares

- Los Balcones

- Los Belones

- Los Canovas

- Los Nietos

- Los Perez (Tallante)

- Los Urrutias

- Los Ventorrillos

- Mar De Cristal

- Mar Menor

- Mar Menor Golf Resort

- Mazarrón

- Mazarrón Country Club

- Molina de Segura

- Moratalla

- Mula

- Murcia City

- Murcia Property

- Pareton

- Peraleja Golf Resort

- Perin

- Pilar de la Horadada

- Pinar de Campoverde

- Pinoso

- Playa Honda

- Playa Honda / Playa Paraíso

- Pliego

- Portmán

- Pozo Estrecho

- Puerto de Mazarrón

- Puerto Lumbreras

- Puntas De Calnegre

- Region of Murcia

- Ricote

- Roda Golf Resort

- Roldan

- Roldan and Lo Ferro

- San Javier

- San Pedro del Pinatar

- Santiago de la Ribera

- Sierra Espuña

- Sucina

- Tallante

- Terrazas de la Torre Golf Resort

- Torre Pacheco

- Totana

- What's On Weekly Bulletin

- Yecla

- EDITIONS:

Spanish News Today

Spanish News Today

Alicante Today

Alicante Today

Andalucia Today

Andalucia Today

ARCHIVED - Alhama promises 50 per cent tax rebates for homes and businesses that install solar panels

Get money off your 2023 Real Estate Taxes for installing solar panels

Oficina de Turismo de Alhama de Murcia

Alhama de Murcia Tourist information office is located on the edge of the Plaza de la Constitución, just a few metres away from the underground car park and the Town hall of Alhama de Murcia.

The tourist office offers free guided audiotours in English which take visitors around the historical sites of interest in Alhama. These be loaned at any time, although allow an hour and a half to complete the tour, and when loaning the audio equipment visitors are asked to leave passports or ID cards with the tourist office.

The office also carries a full range of leaflets for the archaeological museum of Los Baños, which is built around the historic spa which gives Alhama its name, and the mountains of Sierra Espuña, which is also an important area within the municipality of Alhama. Areas such as El Berro and Gebas have a number of interesting routes which can be followed and there are several picnic areas and good walking routes within the Sierra Espuña natural park.

The tourist office also carries leaflets for the many cultural events and fiestas which take place in Alhama throughout the year, including Los Mayos, Semana Santa, Christmas,the Romería of La Candelaria and the Auto de los Reyes Magos in El Berro.

Opening Hours

Winter (September 16 – May 31)

- Tuesday to Friday: 9am-2pm and 4.30pm-7.30pm

- Saturdays: 10am-1pm

- Sundays and Mondays: closed

Summer (June 1 to September 15)

- Tuesday to Friday: 9.30am-2.30pm

- Saturdays: 10am-1pm

- Sundays and Mondays: closed

For more local information, including news and forthcoming events, visit the home page of Alhama Today.

Cartagena

El Carmoli

Islas Menores and Mar de Cristal

La Manga Club

La Manga del Mar Menor

La Puebla

La Torre Golf Resort

La Union

Los Alcazares

Los Belones

Los Nietos

Los Urrutias

Mar Menor Golf Resort

Pilar de la Horadada

Playa Honda / Playa Paraiso

Portman

Roldan and Lo Ferro

San Javier

San Pedro del Pinatar

Santa Rosalia Lake and Life resort

Terrazas de la Torre Golf Resort

Torre Pacheco

Aledo

Alhama de Murcia

Bolnuevo

Camposol

Condado de Alhama

Fuente Alamo

Hacienda del Alamo Golf Resort

Lorca

Mazarron

Puerto de Mazarron

Puerto Lumbreras

Sierra Espuna

Totana

Abaran

Alcantarilla

Archena

Blanca

Corvera

El Valle Golf Resort

Hacienda Riquelme Golf Resort

Lorqui

Molina de Segura

Mosa Trajectum

Murcia City

Peraleja Golf Resort

Ricote

Sucina

Condado de Alhama

El Valle Golf Resort

Hacienda del Alamo Golf Resort

Hacienda Riquelme Golf Resort

Islas Menores and Mar de Cristal

La Manga Club

La Torre Golf Resort

Mar Menor Golf Resort

Mazarron Country Club

Mosa Trajectum

Peraleja Golf Resort

Santa Rosalia Lake and Life resort

Terrazas de la Torre Golf Resort

La Zenia

Lomas de Cabo Roig

CAMPOSOL TODAY Whats OnCartagena SpainCoronavirusCorvera Airport MurciaMurcia Gota Fria 2019Murcia property news generic threadWeekly Bulletin